As employers, you are no stranger to paying Superannuation Guarantee Levy on your employee wages, the current rate being 10%. There are however, some little-known considerations that play an important part in overall compliance and getting them wrong can see big penalties. Moving forward, there will be a heightened focus on Superannuation Guarantee (SG) compliance by the ATO, following the release of a report by The Auditor General titled ‘Addressing Superannuation Guarantee Non- Compliance’ a few weeks ago. The lengthy report detailed the following facts:

- There are total superannuation assets in Australia of $3.3 trillion

- SG contributions for the 2021 financial year totalled $74 billion

- ATO audit activity raised $1.7 million in 2021

- 95% of SG was paid without ATO intervention

- There was approximately $3bn in SG debt at 30 June 2021 that the ATO had not been aggressively chasing through Covid and natural

Some of the recommendations of the report included the following:

- The ATO adopt a preventative approach to SG compliance, which includes the better use of technology and data matching between Single Touch Payroll (STP) and Superannuation Fund contribution reporting

- Targeting of high risk employers including construction, retail, accommodation and the food industry

- Making more resources available in the ATO to step up data matching to ensure compliance

- Prioritise debt recovery and develop performance measures to evaluate debt collection

So what does all of that mean? It means employers can expect more ATO audit activity around SG. There will be a greater use of data matching and a stronger focus on SG/SGC debt recovery!

Does paid mean paid?

The simple answer is no! The popular accepted perception of due dates for payments for SG is the 28th day following the end of each calendar quarter. The reality is that the legislation makes it clear that SG is not deemed paid until it is received by

the trustee of the employee’s super fund. This means that the employer has to allow enough time for a payment to clear their bank account, pass from the clearing house they use and into the trustee’s hands for the employee’s super fund. How long can that

take? A few days up to a couple of weeks is the reality. This leaves employers in an invidious position of being accountable for delays in processing of SG contributions, even though

it is totally outside their control. There is one exception to this and this is only where an employer uses the ATO sponsored Small

Business Superannuation Guarantee Clearing House. In this case, and only in this case, the superannuation is deemed paid when it is received by the Clearing House.

What happens if the SG is paid late?

An obligation to pay the Superannuation Guarantee Charge (SGC) starts when an employer fails to meet their SG obligation by the due date for payment. The SGC is very different to paying SG – it is treated differently from an income tax point of view and there are also large penalties that are at play. Let’s look at the various components of the SGC

- The first component is the Super Guarantee. This is the amount of Superannuation that was not paid on time. Importantly though the calculation base changes in that SG is normally only payable on Ordinary Time Earnings, however under SGC, there is a wider definition at play and it is calculated on a higher base of Salary and Wages. This brings into the calculation amounts like overtime, leave loading and some termination payments (items which are usually exempt from SG).

- There is a nominal interest that accrues on the Super Guarantee Shortfall of 10%

- An Administration fee applies of $20 per employee per quarter for each quarter the super remains unpaid or paid

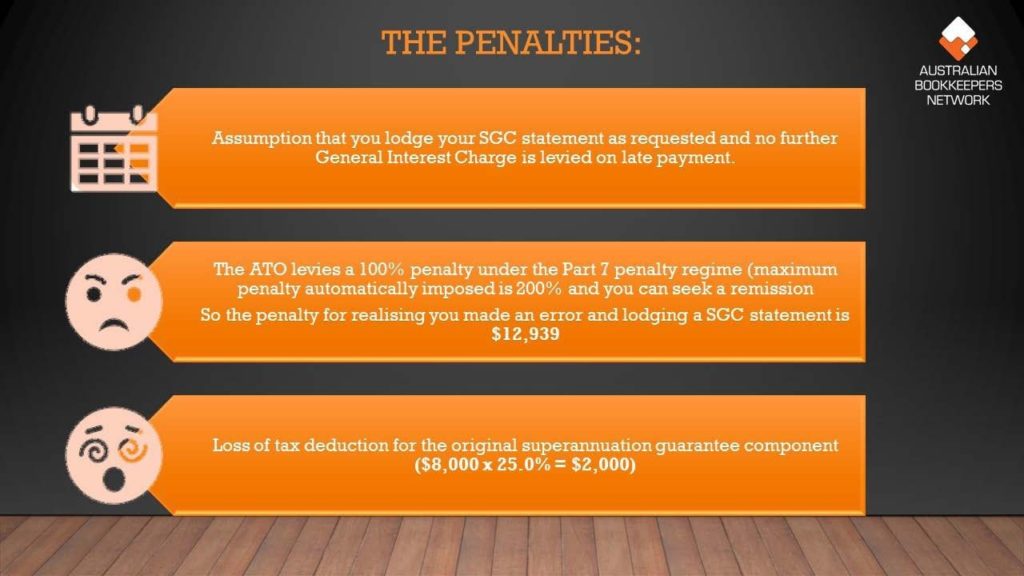

- There is a Part 7 penalty which can be up to 200% of the Superannuation Guarantee shortfall – yes that is no typo

- a maximum penalty of 200%. Pursuant to an ATO directive (PSLA 2021/3) the ATO have discretion to reduce the Part 7 penalty on a case by case

And to top that off the SGC is not tax deductible!!! To add further salt to the wound, Directors can be personally liable and the ATO have the power to issue a Director Penalty Notice to enforce collection.

Remember this applies equally to the situation where SG has not been paid at all vs it was paid but paid late.

Where the SG was paid late, rather than not at all, you are able to make an election to offset the amount of SG that was paid against the SGC, this is known as a late payment offset.

Effectively it means that the employee will not receive the same superannuation twice.

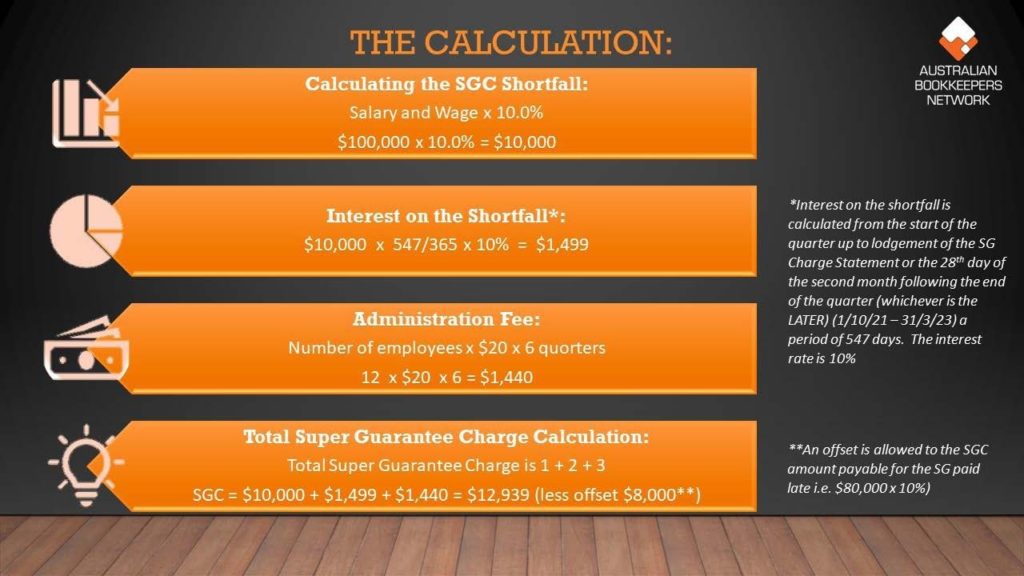

Make no mistake, getting your superannuation wrong will be very costly. Let’s look at the following example which quantifies just how costly it could be.

Example: Super Guarantee (Late Payments)

Joe’s café pay their Super Guarantee for the December 2021 quarter 1 month late. They were advised by their bookkeeper that they now have an obligation to lodge a Super Guarantee Charge Statement and pay SGC. Joe ignored that advice as in his mind the employee’s had received their Superannuation and what did it matter if it was only 1 month late.

Fast forward to February 2023 and the ATO undertakes a data matching exercise and detect the late payment and require lodgment of an SGC Statement. Joe has no choice and completes the SGC Statement on 31st of March. Total wages for the quarter in question was $100,000 and includes overtime for some of the 12 employees. Ordinary Time Earnings for the same period was $80,000 which was the amount the SG late payment was based on.

Let’s turn to the calculation.

Notes

- In the first box you will see that the calculation of the SGC now takes in the wider definition of Salary and Wages which includes overtime which was not previously subject to SG had the payment been made on

- Referring to the last box , Joe has the ability to apply a late payment offset of $8,000 to the SGC being the amount of the super that was originally paid for that

Now hold your breath!!

Conclusion

Had Joe paid the superannuation on time (which in this example was 1 month earlier) the total after tax cost of the superannuation for the quarter was $6,000. After estimated penalties at 100% (it could be more or less than this) the total cost of the Super Guarantee Charge to Joe is $25,878 – almost $20,000 more than had he made the original payment on time.

What to do to avoid this

Well the simple answer is to ensure that SG is paid on time. The more difficult part here is to understand the time that the payment can take to flow from your bank account, through the clearing house and into your employee’s super funds. Cashflow permitting, the best advice is to bring the payment forward – whether that be paying super more regularly like monthly perhaps, or ensuring you give adequate time for the payment to be processed if paying quarterly.

To talk to us about the Superannuation Guarantee Charge, please give us a call on 02 4910 5555 or contact us here.